The practical effects of a prenuptial agreement following the breakdown of a marriage: case study 1

Prenuptial agreements are becoming increasingly popular, especially amongst couples who are getting married for a second or third time.

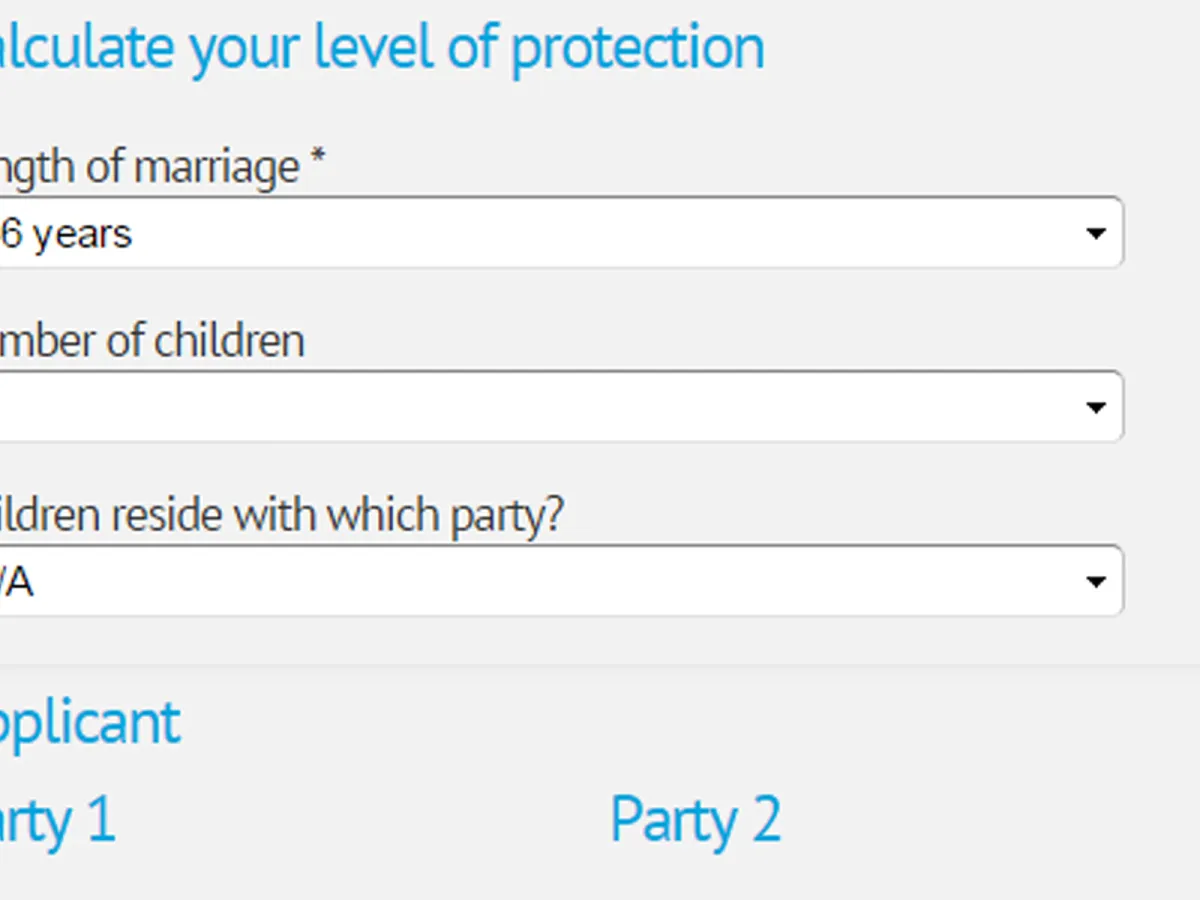

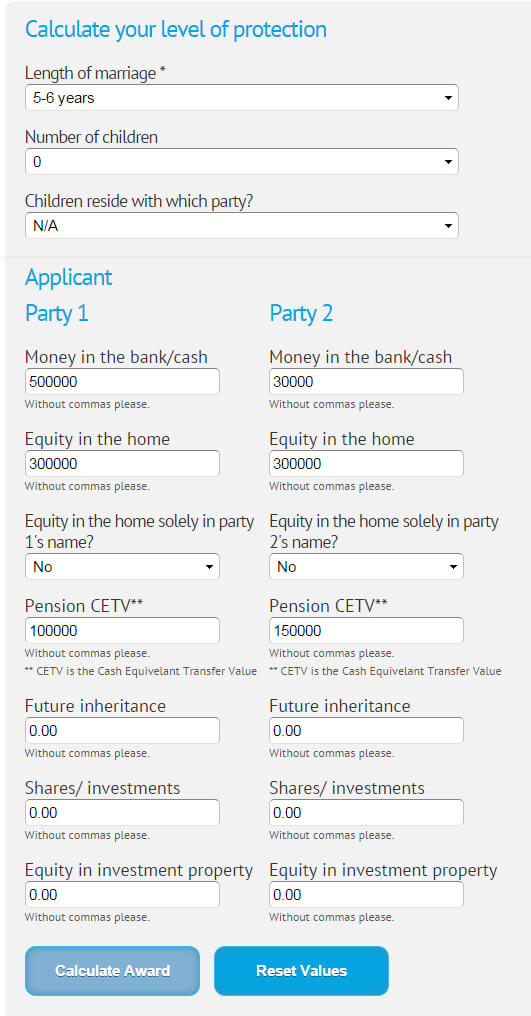

Take Andrew and Sally. They were married in 2009, a second marriage for both. Andrew is 52 years of age. He had been divorced from his first wife for 4 years and has one adult son. Sally is a 49 year old widow with a daughter aged 21 and a son aged 19. All the children are independent of their parents. Sally had inherited £500,000 on her late husband’s death. This consisted of savings and investments. At the time of their marriage, Andrew and Sally jointly purchased a property for £250,000 and each contributed equally to the purchase monies. The property is now worth £300,000 and the mortgage has been paid off. Andrew has £30,000 in savings. Sally has a personal pension with a CETV value of £100,000. Andrew has a personal pension with a CETV value of £150,000.

Prior to the marriage Sally had instructed her solicitor to prepare a prenuptial agreement. She wished to protect her children from her first marriage. It was important to her that in the event that her marriage to Andrew did not work out her children should not lose out on their future inheritance. Andrew understood this and instructed his own solicitor independently. Each party disclosed their financial circumstances in the prenuptial agreement which was entered into approximately two months before the marriage took place. Both families were happy with the arrangements. In the prenuptial agreement Andrew and Sally agreed they would retain their individual assets accumulated prior to the marriage.

Unfortunately the marriage broke down in 2014. Both parties fully accepted that a prenuptial agreement had been entered into and that this was intended to be binding on them both. Their situation was dealt with amicably and as a result of the prenuptial agreement each party retained their individual assets which they had accumulated prior to the marriage. The proceeds of the matrimonial home, which was sold with the consent of both parties, was shared equally between them ensuring both were satisfied with the financial outcome.

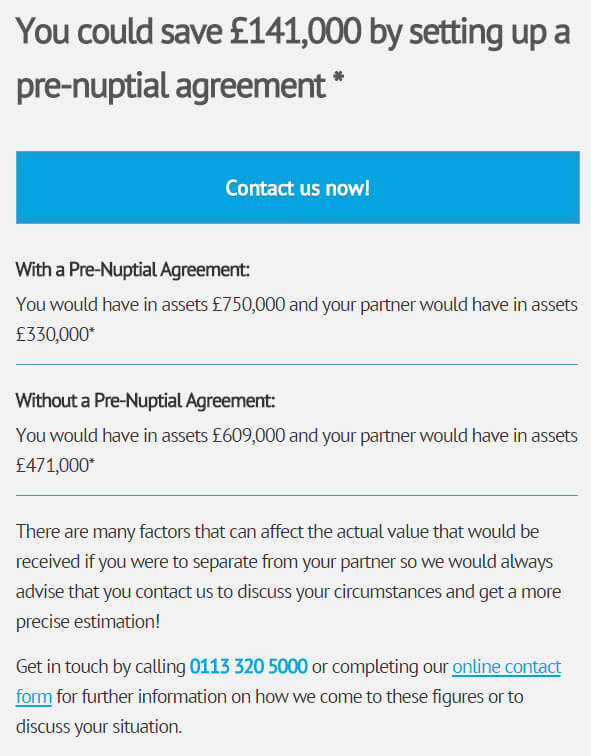

It is envisaged that had a prenuptial agreement not been entered into matters would have been dealt with in an entirely different way. Sally would not have been able to safeguard as much of her assets which she had accumulated prior to the marriage and a settlement would have been far more favourable to Andrew. Using the prenuptial agreement calculator it is envisaged that Sally made a saving of £141,000 by setting up a prenuptial agreement. In addition to this, both parties potentially saved significant legal costs which could have run into thousands of pounds had matters become acrimonious and there could have been significant delay in the parties reaching an agreement. There would have been far more upset and distress. As a result of the prenuptial agreement being entered into, much of this distress and upset was removed from the whole divorce process with the avoidance of needing a Court to resolve the financial matters between them.

Andrew and Sally, plus their children, were all protected through the prenuptial agreement allowing them all to move forward with their lives.

Call us today on 0113 320 5000 for a more detailed look at your situation and to discuss your requirements.