Preparing a pre-civil partnership agreement: case study 2

Similar to pre-nuptial agreements in a marriage, pre-civil partnership agreements are becoming increasingly popular amongst same sex couples.

Take Janet and Alice. They entered into a pre-civil partnership agreement in 2008. There are no children of the family. Janet is 35 years of age. Alice is 33. Janet is a Civil Servant earning £60,000 per annum whereas Alice is a Legal Secretary earning £18,000 per annum. They live together in a semi-detached house in Leeds. This property is in Janet’s sole name and mortgage free. It was purchased by Janet prior to entering into the civil partnership agreement. It is now worth approximately £350,000. Janet has savings and investments of approximately £60,000. Alice has investments of around £10,000. Janet also has a pension with the Civil Service with a CETV value of £250,000. Alice has a personal pension with a CETV value of £80,000.

Prior to the civil partnership being entered into, both Janet and Alice independently obtained legal advice. Janet instructed her solicitors to prepare the agreement, and this was approved by Alice’s Solicitors. The pre-civil partnership agreement excluded each party from making claims against the assets in the other party’s sole name.

Unfortunately, during Christmas 2014, Janet and Alice split up. Janice discovered that Alice had been unfaithful towards her. Janice commenced proceedings for a dissolution of the civil partnership on the grounds of unreasonable behaviour as it is not possible to proceed on the grounds of adultery in a civil partnership case.

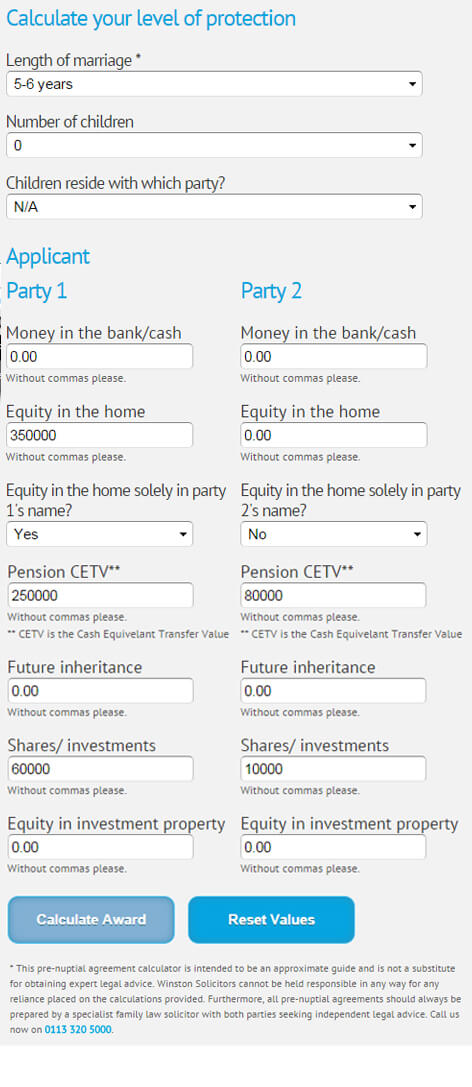

Both parties acknowledged that they had intended the pre-civil partnership agreement to be legally binding on them. However, Alice requested that there should be some variation from the agreement in view of the fact that they had been together in the civil partnership for 6 years and her limited financial circumstances. With the help of her solicitor, Alice was able to negotiate a settlement with Janet of approximately £26,000 which Janet has paid out of her savings. However, had a pre-civil partnership agreement not been entered into it is envisaged that Alice would have been able to negotiate a much more favourable settlement, and the pre-civil partnership agreement has saved Janet approximately £59,000.

Call our specialist Family Law Solicitors based in Leeds today on 0113 320 5000 for a more detailed look at your situation and to discuss your requirements.

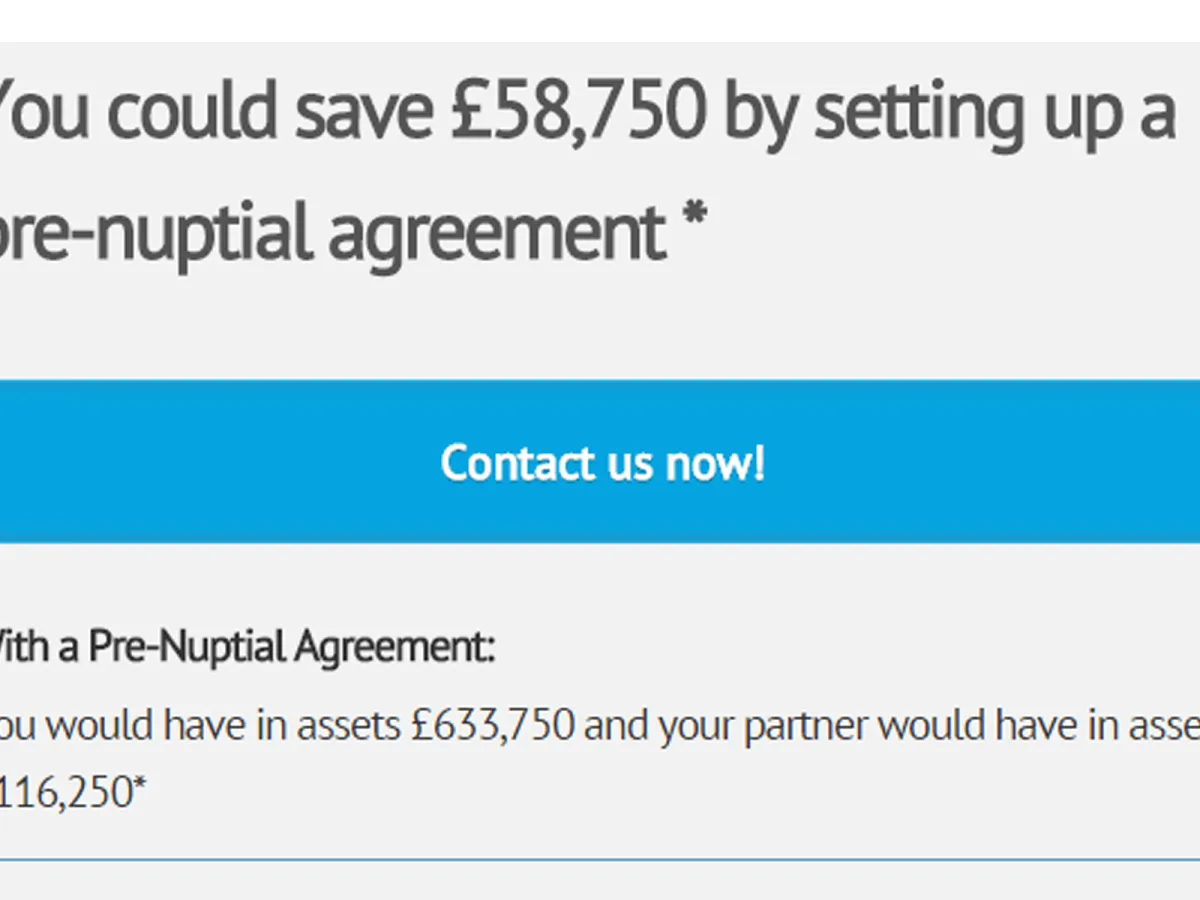

Try our pre-nuptial calculator to see what you may save with a pre-nuptial agreement or pre-civil partnership agreement. Our FAQ page covers queries you may have about using the calculator.