Step 1 - Ensure you are confident that there is not a valid will

If you cannot find the deceased’s will amongst their possessions, then you should try contacting:

- The deceased’s solicitor. If you are unaware of who the deceased’s solicitor was then you may want to consider contacting local solicitors to make enquiries

- The deceased’s bank (some people store important documents with their banks)

- A will search company

- London Principal Probate Registry

If a will is not located, then it is assumed that the deceased did not have a will when they died.

Step 2 - Notify the relevant institutions of the deceased’s death and collect information

You must notify all relevant government organisations that the deceased has died. Tell Us Once is a government service that allows you to report a death to the majority of government organisations in one go (you get a reference for it when you get the death certificate). You must also notify all the relevant institutions which the deceased was connected with, such as banks and building societies, utility companies, etc to determine what the deceased’s assets and liabilities are.

Step 3 - Apply for authority to deal with the deceased’s estate

You should refer to the Intestacy Rules to determine who has the authority to apply for the Grant of Letters of Administration, such as a spouse, children, parents, siblings, etc. There is an order of priority.

Step 4 - Ensure all of the deceased’s debts are paid and collect in their assets

Step 5 - Distribute the estate in accordance with the intestacy rules, which are as follows:

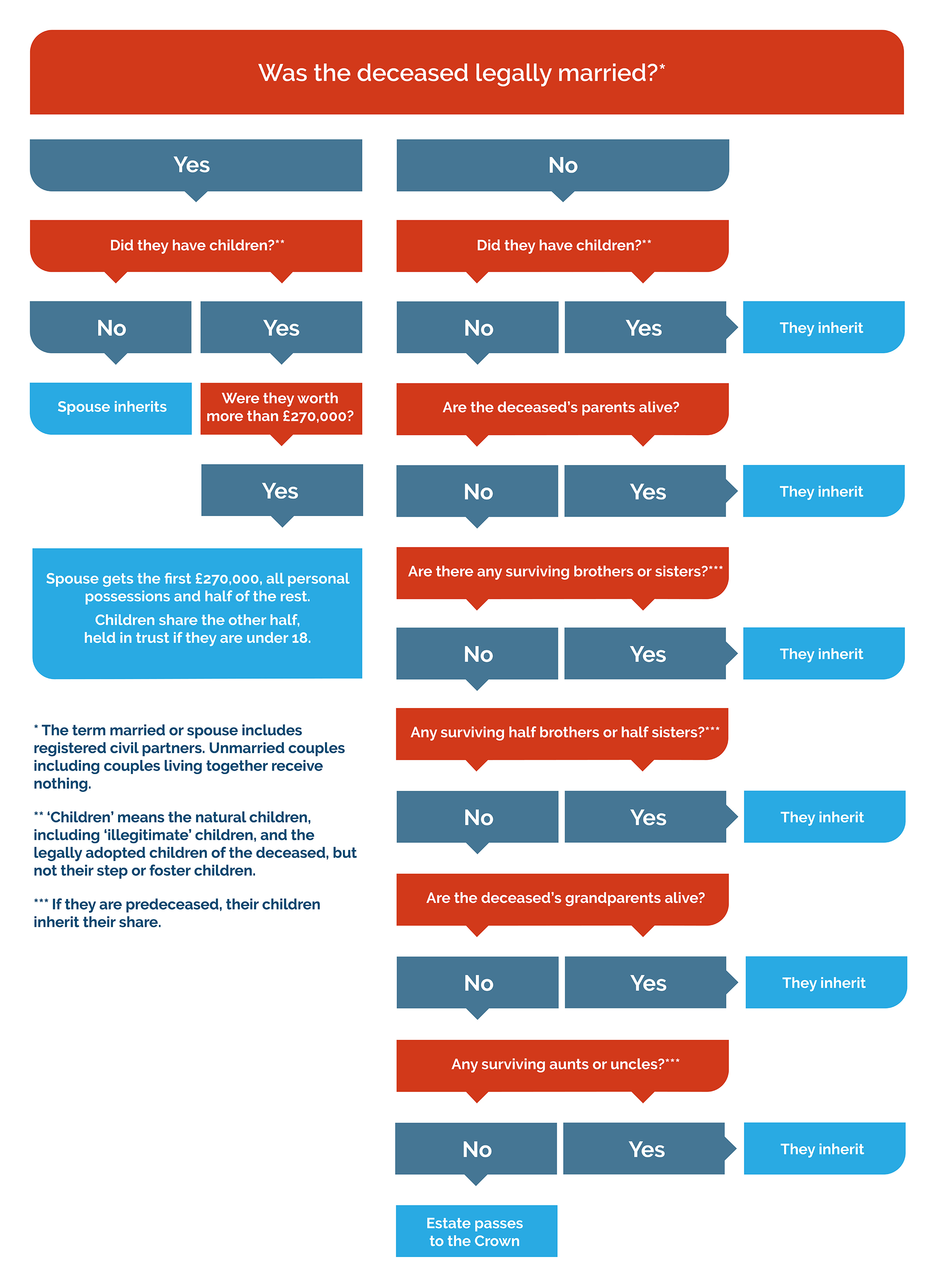

As shown by the diagram, your estate would be left in this order of priority if you die without a valid Will. Therefore, it could mean people you would want to benefit from your estate will not.

Probate is the word normally used to describe the process of dealing with the estate of a person who has died. In general, there are two different types of grants:

- Probate - applied for if the person who died had a valid will

- Letters of Administration - applied for if the person who died did not have a valid will

It is important to write a will if you would like to choose what happens to your assets after your death. If you do not write a will, you will have no control over your assets, which will be distributed according to the Intestacy Rules. A person who dies without a will is called “intestate”.

If a person who died did not have a will then the person who is granted Letters of Administration is called the administrator. This is a similar role to an executor of a will.

If you do not make a will then the intestacy rules apply on your death. These rules contain a pecking order of who can inherit based on your family situation. This can mean that those who you wish to benefit from your estate could lose out and it could cause considerable hardship to them.

An application to the Probate Registry for a Grant of Letters of Administration will need to be made by the next of kin of the deceased.

A person can usually apply to be an administrator if they are the next of kin (a close relative) of the deceased or were married to or in a civil partnership with the deceased. The rules of intestacy will apply.